Featured Content

The Future of Health Financing in Africa: The Role of Health Taxes

This brief describes the context of health taxes in Africa. It focuses on three high-impact product categories: tobacco, alcohol, and sugary drinks. These are major contributors to the continent’s NCD burden, and targeted taxes on these products can deliver outsized benefits. The brief explores the role of health taxes in domestic resource mobilization, providing country examples and policy design considerations.

Cost Recovery and Revenue Estimator (CoRRE)

CoRRE is designed for the public health community, advocates, and policymakers to assess the economic cost of smoking that can be recovered through reduction in smoking in their countries.

Fix the Price Tag on Health

The companies making us sick are making billions. Our health, our economies and our future are paying the price. But there’s a proven solution: health taxes on harmful products like tobacco, alcohol and sugary drinks. Health taxes save lives, reduce health care costs, and generate revenue that can fund vital public services.

Why Health Taxes Matter: A Call to Action

Noncommunicable diseases (NCDs) such as cancers, diabetes and heart disease are among the leading causes of premature death and disability worldwide. They also strain health systems, reduce productivity, and increase poverty—especially in low- and middle-income countries. Fortunately, there is an effective public policy tool to address these challenges: health taxes.

Taxing unhealthy commodities such as tobacco, alcohol, highly processed foods and sweetened sugary beverages are a WHO “Best Buy.” When well-designed and implemented, health taxes save lives, reduce preventable disease, and generate revenue for the public good.

The cost of inaction is enormous: Trillions of dollars lost in economic output, escalating rates of NCDs, and millions of people lost to preventable and premature deaths. Yet, advancing these policies is complex. It requires coordination across finance, health, trade, and other sectors—and often means facing fierce resistance from powerful commercial interests.

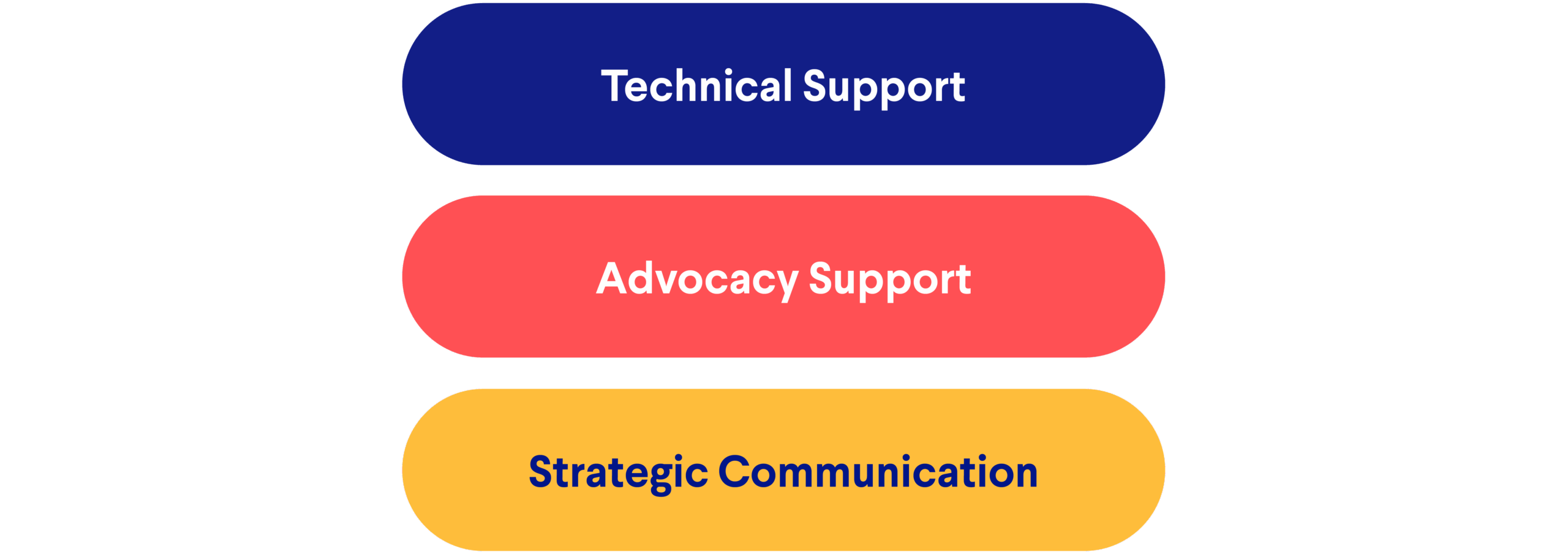

We and our partners provide the following support to governments and civil society working to advance health taxes:

At Vital Strategies, we partner with governments, civil society, and local and regional institutions to overcome these barriers in 10+ countries. Drawing on experience from efforts in 30+ countries and cross-cutting expertise in policy development, economics, public health, advocacy, and strategic communication, we help catalyze and sustain health tax initiatives that protect populations and promote economic resilience.

Vital Strategies’ Role: Helping to Create the Conditions for Success

Vital Strategies works within robust coalitions of governments, civil society, and regional partners to catalyze and sustain strong health tax policies. Drawing on our cross-cutting expertise in public health, economics, legal and tax policy, advocacy, and strategic communication, we provide tailored support to design and implement health taxes that save lives and strengthen economies.

Together with our partners, we offer the following:

1. Technical Support

In partnership with universities and other research institutions, we support:

A. Economic Research and Evidence Generation

Detailed and credible economic research is critical to ensure tax design is effective and defensible. In partnership with governments and global experts, we support local think tanks and academic institutions to:

- Model expected tax revenues

- Estimate price elasticity of demand

- Project economic and employment impacts

- Analyze household expenditure patterns and distributional effects

B. Tax Policy Design

Health taxes require detailed legal and policy analysis. We support:

- Legal drafting of tax legislation

- Balance between ad valorem and specific taxes

- Earmarking and revenue allocation mechanisms

- Harmonization across jurisdictions

C. Epidemiologic Analysis

Sound data on health impacts underpins successful tax policy. We assist with:

- Compiling and analyzing data on disease burden from harmful products

- Modeling public health outcomes from proposed taxes

- Assessing differential impacts across population subgroups

2. Advocacy Support

In partnership with global and local civil society organizations, we support:

A. Legislator Engagement and Education

Industry lobbyists often bombard legislators with misinformation that contradicts public health goals. We help counter this by providing:

- Timely, accurate, evidence-based briefings

- Technical summaries aligned with national development priorities

- Clear messaging that demystifies tax policy for lawmakers

B. Organizing Civil Society Coalitions

The burden of unhealthy commodity consumption is shared across sectors—health, gender, education, labor, and more. We help build multi-stakeholder coalitions by:

- Mobilizing diverse voices across intersecting interest groups from cancer to worker’s rights, child protection, women’s health, the environment, agriculture, road safety and gender-based violence.

- Coordinating joint advocacy strategies

- Elevating civil society leadership in public discourse

3. Strategic Communication

A. Mass Media and Social Media Campaigns

Strategic communication is essential to inform the public, shift norms, and counter industry disinformation. We support:

- Message testing and audience segmentation

- Development of culturally relevant creative assets

- Media placement strategies

- Monitoring and evaluation of communication effectiveness

B. Polling and Public Opinion Research

Public support for health taxes is often underestimated. To equip policymakers and advocates with insight into public attitudes, we:

- Conduct high-quality, nationally representative polling

- Explore citizen preferences around tax revenue allocation

- Identify effective narratives and trusted messengers

- Conduct behavioral and social science research and analysis to design effective public health messaging

C. Journalist Engagement

Journalists play a vital role in shaping public discourse. We support:

- Journalist trainings to strengthen understanding of health taxes

- Technical support for news features, op-eds, and investigative reporting

- Relationships between civil society leaders and media professionals

4. Strategy, Coordination and Management

Successful tax initiatives require coordinated, multi-disciplinary action. We help align efforts across stakeholders and sectors by:

- Coordinating technical, advocacy, and communication activities

- Aligning global best practices with national strategies

- Mobilizing partners and facilitating peer-to-peer networks and learning

- Adapting strategies to shifting political and policy environments

Vital Strategies in Action: Program Highlights

Tobacco Control Program

As a lead partner in the Bloomberg Initiative to Reduce Tobacco Use, we collaborate with governments and civil society to implement the WHO Framework Convention on Tobacco Control and the MPOWER package.

Active in 50+ low- and middle-income countries, we support stronger tobacco taxation—recognized as the most effective, cost-efficient policy to reduce tobacco use.

Food Policy Program

As a partner in the Bloomberg Philanthropies’ Food Policy Program, we currently support partners in Barbados, Brazil, Colombia, Jamaica, and South Africa.

We advance healthy food policies through:

- Research and impact modeling

- Strategic communication campaigns

- Rapid response and coalition building

- Public and policymaker engagement

Alcohol Policy Program

RESET Alcohol is a first-of-its-kind global initiative that brings together governments, civil society, and researchers to advance the WHO SAFER alcohol policy best buys, focusing on:

- Increasing alcohol taxation

- Restricting marketing and availability

- Providing financial, technical, communication, and advocacy support to partners in target countries

Resources

Tobacco Tax

Tools

Campaigns

Policy Briefs

- Benefits of a Tobacco Tax Increase and Tax Simplification in Indonesia

- Higher Tobacco Taxes for a Healthier Timor-Leste (Policy Paper)

- Excise Duty Amendment Act, 2023 and the Tobacco Industry Interference Report (Ghana)

- Tobacco Taxes Promote Equity: Evidence from Around the Globe (STOP Industry Brief)

- The Price We Pay: Six Industry Pricing Strategies (STOP Report)

Fact Sheets

Sugary Beverages/Ultra-Processed Foods Tax

Case Studies

- Lessons from South Africa’s Sugary Drinks Tax Campaign

- Colombia’s Groundbreaking Tax on Sugar-Sweetened Beverages

- Why a Sugary Drinks Tax Matters in Jamaica

Peer-Reviewed Papers

- Instrumental Role of Strategic Communication to Counter Industry Marketing Responses to Sugary Drink Tax

- How the “Are We Drinking Ourselves Sick?” Communication Campaign Built Support for Policy Action on Sugary Drinks in Jamaica

Campaigns

Alcohol Tax

Policy Briefs

- Trouble Brewing: Making the Case for Alcohol Policy (Report)

- Estimation of the direct and indirect costs attributable to alcohol consumption in Brazil (2023)

Fact Sheets

- Why Raise Taxes on Alcohol?

- Taxing Alcohol Is Good for the Health of Brazilians

- Taxing Alcohol Is Good for Brazil’s Economy

- Raising Taxes on Alcohol Can Reduce Violence and Injuries

- Brazilians Support Alcohol Taxes

- Taxing Alcohol Protects Brazil’s Youth

- Taxing Alcohol Leads to Safer Streets

Campaigns